Table of Content

State Bank of India accepts co-applicants provided they have a regular source of income or salary with documents to be furnished as proof of salary or income. This is mainly because the EMI will be less, which ensures timely repayment from your side. JLGs that undertake savings apart from credit are required to maintain books of accounts. However, the quantum of credit need not be linked to groups’ savings as in the case of SHGs. The credit requirements for the group may be worked out based on combined credit plan needs of individual members. Each member of the JLG should be provided an individual KCC / GCC or term loan.

One cannot avail of a joint home loan with any random person. Close friends and family members who could be trusted shall be allowed to apply for this loan. Succession and other legal issues are reduced if couples are joint owners of the property.

Corporate Accounts Group (CAG)

The best situation for taking a joint home loan is with a working spouse. You can pool your incomes together and apply for a higher home loan. This way, you will have the support of your spouse for repayment, and both of you will get double tax benefits. There are many benefits of taking a joint home loan instead of taking a home loan just by yourself. First and foremost is the benefit of getting a higher loan amount. If you want to purchase a large home, you need a huge loan amount.

Tax advantages are only available for sums paid by you; therefore, you can't claim them on the house loan in this scenario. CORPORATION Bank though it is a Nationalized bank the charges are very high. Another constraint is,they dont intimate us, when there is a fall in the rates. It is not a joint loan, finally I had transferred my home loan from this bank to HDFC LTD. DHFL housing loan is simply great , they are doing really good.

Account

Magicbricks is only communicating the offers and not selling or rendering any of those products or services. It neither warrants nor is it making any representations with respect to offer made on the site. To get an edge at your home loan eligibility, you can mention your additional income and also state the sources. Depending upon the applicants of the loan, the tenure can vary from year to year. • To avail, this benefit the home loan should not be over Rs. 35 lakh, and the value of the property should be within Rs. 50 lakh.

As for the share-based partition of the property between two parties, there will be no disagreement. While you can apply offline, it is a lot quicker to fill the easy online application form and apply online. The lender will go through the information you provided and evaluate your eligibility for a Home Loan. Given that the proposed House Property is acquired in joint names of the Proprietor and the Proprietary Firm, the firm should be an existing borrower or a debt-free entity. Succession and other legal issues are reduced if the husband and wife jointly owns a property. You are just one step away from using Home Loan related services.

How can both husband and wife claim home loan interest?

The maximum interest deduction for a self-occupied property is Rs 2,000,000 per co-owner who is also a co-applicant. As a result, each owner receives a portion of the total interest paid on the loan. It should go without saying that the total interest claimed by the owners/borrowers cannot exceed the total interest paid on the loan. Banks offer joint house loans to persons who have a certain type of relationship with each other. Check with the bank first to see whether it will grant you a combined house loan, say with your sister.

Our commitment to nation-building is complete & comprehensive. SBI Home Loans come to you on the solid foundation of trust and transparency built in the tradition of SBI.

You can also use the Loan EMI Calculatorto know the cost of borrowing before you avail funds and to plan your loan efficiently. You can also use the home loan eligibility calculatorto check your loan eligibility online easily. HDFC LTD did not return my call though I had asked them to call me back. I had purchased a land and I am planning to construct a property shortly. Each co-applicant has to fill in a separate application form and provide individual documents for the same loan.

Both parties will have to produce comprehensive paperwork stating the same to receive the tax benefits. To take advantage of the joint home loan tax benefit, you'll need to get this paperwork from your bank's branch. Searching for a perfect home can be a long and exhausting process. Your home should meet your preferences, comfort, and, most importantly, your budget.

As you go through this article, you’ll explore what exactly is a joint home loan, how to apply for it, why the joint home loan is better than an individual home loan, its features, and benefits. So let’s invest some time to fulfill your inquisition towards Joint Home loans. Having the non-working spouse as a co-applicant for cheaper stamp duty and lower housing loan interest rates might still be beneficial, however, since many banks provide house loans at lower rates for women. Taking a joint loan can help you increase the home loan amount, and the chances of getting your home loan application approved are also higher. Another significant benefit that joint home loans offer is substantial tax benefits that all the co-applicants can avail themselves of. The tax laws allow you to avail certain benefits with respect to respect home loans.

The rate of interest charged was floating, fortunately till date there was no rise in the interest rate. I have bought home loan in HDFC Ltd since i know the people working over there, i have chosen this bank. I applied the loan amount of Rs. 62 lakhs which is a joint home loan and they have sanctioned the same. You can have a maximum of 6 applicants and a minimum of 2 applicants in a joint home loan. However, the number of co-borrowers depends on the bank’s discretion.

The co-borrower could be salaried or self-employed, engaged in business or a profession. If you decide to make your homemaker mother the joint applicant, then neither of the above uses will be available to you. The repayment of EMI for a joint loan has to be made from a joint account owned by the co-applicants.

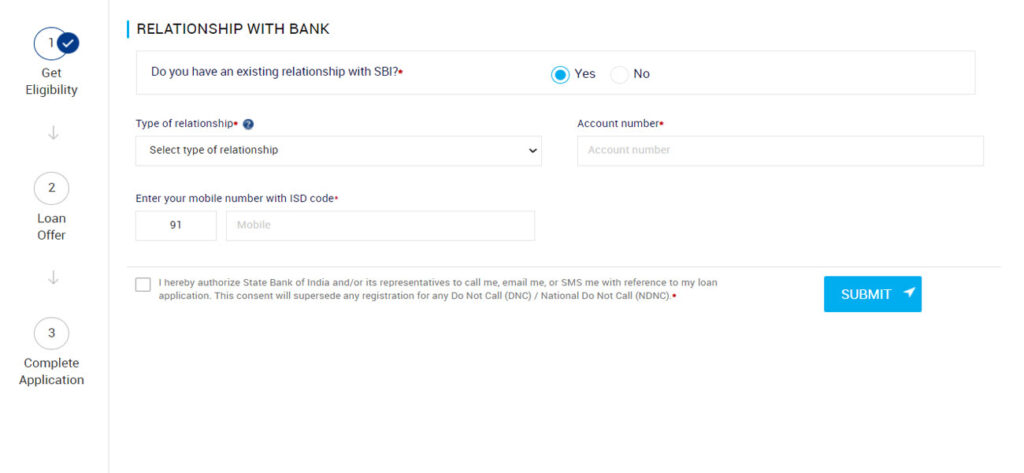

Enjoy competitive interest rates and reap the benefits of affordable EMIs. Once the documents are reviewed and the Home Loan is approved, the loan amount is disbursed into your SBI account. Fill in your personal, financial, professional and property related details as required and submit the application. Pay higher down payment– Loan-to-value ratio is another factor that determines your eligibility. If you want ensure that you qualify for a Home Loan, make a higher down payment and bring down your LTV ratio. This will lead to a lesser loan amount and increase your chances of getting a Home Loan.

No comments:

Post a Comment